{“1”: “

Author: Changan, Amelia I Biteye Content Team

rn

rn

Meme is receding, prediction markets are taking over. This is not speculation; it is a massive capital migration happening right now.

When Polymarket secured a full U.S. license and received a $2 billion investment from the parent company of the New York Stock Exchange, you should understand:

rn

The era of meme coins about cats and dogs is over; the era of speculating on “truth” has officially begun.

rn

This article will guide you to:

rn

See why prediction markets have suddenly exploded;

rn

Review the dark horse projects on BNB Chain worth accumulating;

rn

Step-by-step teach you how to position early and capture the early-stage benefits.

rn

1. Why Have Prediction Markets Suddenly Become Hot?

rn

The moment market sentiment truly shifts is often not a crash, but numbness.

rn

You will find: shitcoins are still being launched, but you can’t be bothered to click on them;

Narratives are still flying, but the only thought left in your mind is: they will all go to zero anyway.

rn

Meme didn’t die suddenly.

rn

It died from a structural contradiction: tokens are permanent, but attention is instantaneous.

rn

When Pump.fun lowered the barrier to token issuance to near zero, supply began to expand exponentially; while retail investors’ time, emotions, and capital are linear. The result is only one: hype cycles become shorter, and prolonged declines become longer.

rn

At this moment, a new type of gameplay that appears “less exciting” but more brutal began quietly absorbing the capital flowing out of meme.

rn

It is called: prediction markets.

rn

1.1 The More Uncertain the World, the More People Need Truth

rn

In this era of information explosion and fragmentation, media often only provide timeliness of news but cannot guarantee accuracy.

rn

For example: someone used AI to forge a CZ autobiography, complete with cover, outline, and uploaded to Apple Books and other publishing platforms, even fooling media outlets. At that time, the meme’s market cap was even hyped to three million dollars.

rn

Under meme mechanisms, speculators can learn news first by scanning the chain, but they often become liquidity for rumors. Because in the “speed is everything” logic, the cost of verifying truth is too high; by the time you check and verify, the coin price may have already gone to zero.

rn

This is precisely the significance of prediction markets: they introduce a Skin in the Game mechanism, forcing participants to reveal true expectations through real-money gambling.

rn

Its logic is simple: Talk is cheap, show me the money.

rn

Prediction markets are the process of converting “cognition” into “assets.” In the initial state where Yes and No each account for 50%, participants vote for information with real money; the more buyers, the higher the price, and price fluctuations quantify the real probability of an event happening in real-time.

rn

1.2 From “Speculating on Coins” to “Speculating on Events”: Speculation Upgraded

rn

The fundamental reason for meme’s decline is: asset issuance is too fast, and attention runs even faster. When attention disperses, what remains are permanently existing tokens, making prolonged declines the norm.

rn

Prediction markets solve these problems:

rn

- rn

- Clear settlement date: Focuses speculative capital on the window period when events occur; once the event ends, funds settle, and there are always winners. Solves the problem of meme’s prolonged decline torture.

- Speculator-friendly: Through clear win/loss outcomes, ensures users can always obtain settlement profits, fundamentally improving the survival environment for speculators.

- More concentrated capital: No longer troubled by infinite forked coins or same-name tokens; instead, attention is focused on limited important events.

rn

rn

rn

rn

This is not just a change in gameplay; it is a dimensional upgrade in speculation. You don’t need to be faster than others; you just need to be more accurate.

rn

1.3 Compliance Breakthrough, Institutional Entry

rn

Prediction markets are hot not only because of good mechanisms but also because they are recognized by regulators.

rn

On September 3 this year, Polymarket CEO Shayne Coplan successfully ended a years-long tug-of-war with regulators. Polymarket broke Kalshi’s long-term monopoly in the compliant market, proving that prediction markets can break out from the “legal gray zone” and transform into transparent, compliant “information derivatives markets.”

rn

A little over a month later, on October 7, the New York Stock Exchange’s parent company ICE injected $2 billion, bringing prediction markets into Wall Street’s view. This marks prediction markets officially entering the global financial core as a new asset class.

rn

The compliance breakthrough completely eliminates legal concerns for institutional capital entry. Prediction markets are rapidly shedding the label of “crypto niche toys” and evolving into financial infrastructure that quantifies global risks and public opinion trends, on par with the S&P index and gold prices.

rn

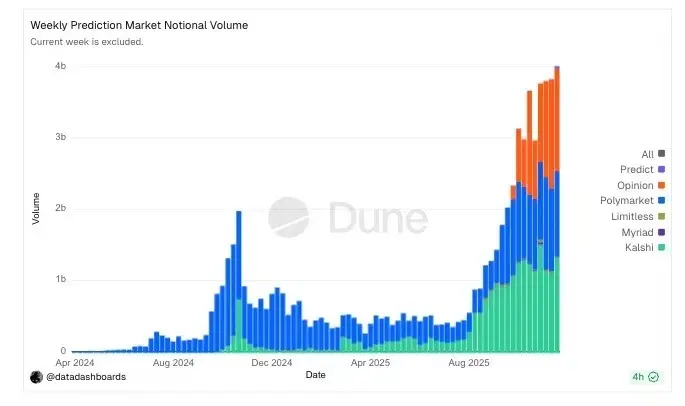

As shown in the chart, weekly trading volume in prediction markets recently saw an unprecedented exponential explosion, with peaks exceeding $4 billion.

rn

(Data source: Dune)

rn

rn

2. The Leaders and Rising Stars of Prediction Markets

rn

2.1 Kalshi: The Lone Warrior Confronting Regulation Head-On

rn

Before discussing prediction markets, we must first pay tribute to Kalshi. If Polymarket gained freedom through a backdoor, Kalshi tore open the compliance gap by confronting regulators head-on.

rn

Before 2024, U.S. prediction markets were largely in a gray area, with the biggest uncertainty being regulatory attitudes. Kalshi secured a CFTC Designated Contract Market (DCM) license as early as 2020, becoming the first regulated platform focused on event contracts. Subsequently, in the approval of political contracts, it fought a protracted battle with the CFTC—between 2023 and 2024, the CFTC once banned related contracts; Kalshi directly sued and won in court, ultimately forcing the CFTC to drop its appeal in 2025.

rn

This victory is seen by many as a key turning point in the legalization of prediction markets: this is not gambling but a protected financial derivatives market.

rn

The cost of compliance seems high, but what it buys is institutional-level trust and a regulatory moat. Kalshi is the earliest and most mature fully CFTC-regulated platform, allowing U.S. institutions and retail investors to legally trade event contracts directly with dollars. Although competitors like Polymarket gradually re-entered the U.S. market by the end of 2025, Kalshi’s first-mover advantage and strict compliance model still make many feel the cost is worth it.

rn

But the cost of compliance is self-isolation. Strict KYC, limited to U.S. users only, operating within a “local network” of the U.S. market. This weakens its connection with the broader global user base.

rn

2.2 Polymarket: The First-Generation King, But Not the Final Chapter

rn

If Kalshi won in court, then Polymarket undoubtedly won in the market; capital markets gave the answer with the most real money.

rn

This year, its valuation jumped three levels, rapidly soaring from the $1 billion unicorn threshold at the beginning of the year to $8 billion (receiving a $2 billion investment from ICE, the parent company of the New York Stock Exchange), and even recently rumors emerged that it is seeking a new round of valuation at $15 billion.

rn

During the U.S. election, it carried massive capital gambling. For the “2024 U.S. Presidential Election” prediction pool alone, cumulative trading volume exceeded $3.2 billion.

rn

Looking deeper, Polymarket’s success stems from dual victories in product and compliance:

rn

From a product perspective: It极力淡化”赌博”属性,转而强调信息属性. During the election, even CNN and Bloomberg cited its odds. It successfully built a sense of authority, making users feel that betting is not gambling but pricing information.

rn

Moreover, compared to early prediction markets like Augur, Polymarket minimized user experience to the extreme. No obscure on-chain interactions; directly settled with USDC stablecoin. It allows Web2 users to seamlessly enter prediction markets.

rn

From a compliance perspective: Polymarket proactively settled with regulators (CFTC). This “fine” was actually a “ticket” into the mainstream world; it cleared compliance obstacles and paved the way for entering the U.S. market.

rn

But this compliance + focus-on-top approach has a ceiling.

rn

Polymarket’s success is built on a highly controlled, heavily operated model. Although this model is safe, it is extremely inefficient. It is like a fine handicraft workshop, heavily reliant on the official team’s taste and institutional capital to operate. This makes it perform perfectly when facing super products like the U.S. election, but once it needs to handle more fragmented, higher-frequency public demands, this centralized framework appears too slow and too heavy.

rn

It successfully validated prediction markets from 0 to 1, but several core contradictions hindering the industry from 1 to 100 explosion remain unsolved in its model.

rn<h2 dir="ltr" style="margin-bottom: