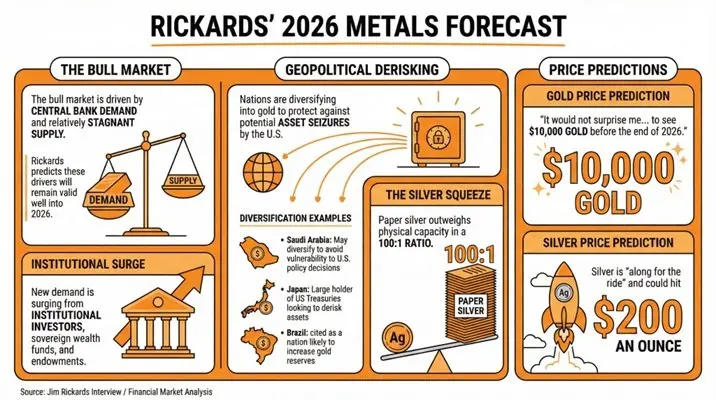

ChainCatcher News, according to a report by Gelonghui, economist, financial analyst, and bestselling author of “Currency Wars” Jim Rickards stated that he would not be surprised if the price of gold reaches $10,000 and silver rises to $200 by 2026. He noted that the various factors driving the entire precious metals market, with gold as the leader, will continue to play a role next year:

1. The traditional drivers behind the current gold bull market—namely, central bank demand and relatively stagnant supply—will remain effective for a considerable period in 2026.

2. The surge in new, non-traditional factors may push prices even higher. Rising demand from institutional investors—including sovereign wealth funds and endowments—could drive prices up further.

3. Geopolitical risk aversion—recent attempts by Europe to seize Russian assets may also be influencing gold demand, as some countries have begun allocating to gold to hedge against potential U.S. asset seizure risks.